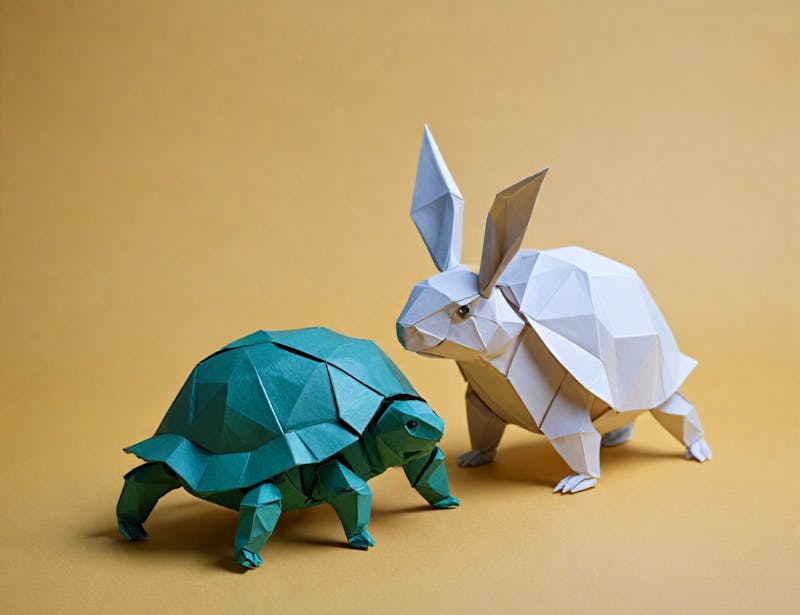

The Tortoise and the Hare: Why Slow and Steady Wins the Investment Race

We've all heard the fable of the tortoise and the hare. While the hare speeds ahead initially, the tortoise's consistent, unwavering pace ultimately leads it to victory. This age-old story holds a valuable lesson, not just in fables, but also in the realm of personal finance.

For many, building wealth conjures images of high-rolling investors making risky bets in pursuit of quick returns. However, the reality is often far less glamorous. The true path to financial security often lies in a different strategy altogether: consistent saving and disciplined investment.

Let's delve into a scenario that challenges the conventional wisdom of "bigger is better" when it comes to building wealth. Imagine Sarah, a young professional with limited income. Unlike many, she doesn't wait for a sizeable windfall or a "perfect" time to start investing. Instead, she embraces the power of small, consistent contributions. She sets up autosave, a convenient feature that automatically transfers a fixed amount (say, 50,000 shillings) from her salary account directly to her investment account every month. This approach ensures discipline and eliminates the temptation to spend.

Five years later, Sarah's friend Michael, finally feeling financially secure, decides to invest. He opts for a more aggressive approach, doubling Sarah's monthly contribution (100,000 shillings) but for a shorter period (five years). Both have the same risk tolerance getting exposed to the same assets offering a 10% annual return.

Here's the surprising twist: after their respective journeys, Sarah, the seemingly conservative investor, emerges with 10.2 million shillings. Meanwhile, Michael, despite his larger, shorter-term investment, ends up with only 7.4 million shillings. While each have deposited 6 million shillings total, Sarahs interest is 2.8 million shillings more than Micheal.

The key to Sarah's success lies in the power of compounding interest. Her consistent contributions, starting early and continuing for a longer period, snowball over time. Each day, weeks and months interest earns interest on itself, creating an exponential growth trajectory that surpasses Michael's initial larger investment.

This dismantles the myth that bigger investments automatically lead to faster wealth creation. So, how can you emulate Sarah's success? Here are three secrets:

- Embrace Autosave: Set up an automatic transfer of a fixed amount from your salary account to your investment account. This removes the temptation to spend and ensures consistent saving.

- Start Small, Grow Big: Don't wait for a large sum to begin. Even UGX 5,000 monthly can blossom into a substantial amount over time.

- Patience is Key: Don't get discouraged by short-term fluctuations. Remember, the longer your money stays invested, the more compounding works its magic.

- Emergency Fund is Crucial: Establish a separate emergency fund to avoid dipping into your long-term investments for unforeseen expenses.

So, the next time you're tempted to follow the "get rich quick" schemes, remember slow and steady truly wins the race to financial freedom, and the "penny pinchers" might just be leading the pack.